Starving the App Ecosystem

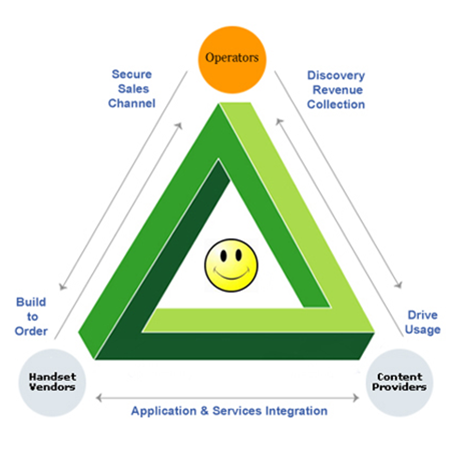

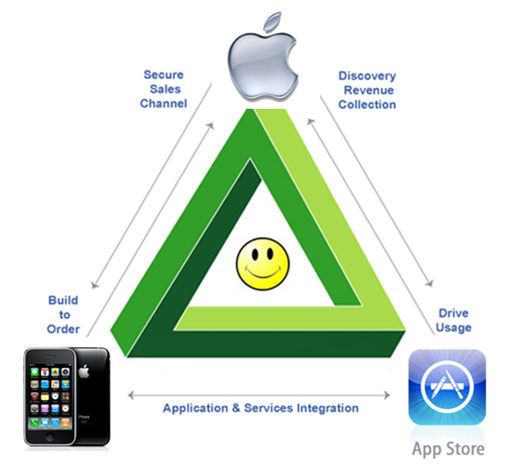

This article via NYT “As Boom Lures App Creators, Tough Part Is Making a Living” made the rounds and while it’s clearly focused on the US market.. it’s obviously a global issue. We have mentioned several times over the past few years, both in private and public, the business model deployed by Apple and Google for their App platforms was missing a key Japanese ingredient – recurring and sustainable revenue for developers. For starters; it should come as no surprise by now – despite most initial “huh” remarks when we’ve pointed out back in 2008, that the original platform model for this industry is actually imode 1999. The images below have been a standard insert on our deck and should address any initial ‘confusion’, the so-called benevolent dictator on top of the pyramid clearly need not be a DoCoMo styled telco in order to manage the value-chain.

imode ecosystem

Apple ecosystem

That said.. there are two key differences for content & service product developers between the original made in Japan approach and what has become (in)famous App Store overseas: Revenue Share and Recurring Subscriptions.

The revenue split here has always been 90/10 (91/9 to be precise) which was considered rich in it’s earliest interaction, when compared to settlement fees for credit card companies, but it stuck. Generally the immediate respond from global folks always comes back with ‘size of, far larger, addressable market’ theory.. which to be honest never made sense in the first place as increased volume usually means bulk margins.. but anyway = Balls. When V-Live, based directly on Vodafone’s experience in Japan, decided to take this carrier managed platform into Europe they approached many of the local players here on that exact logic, with a 50-50 share thank-you very much, we all know how that worked out. To be fair accurate, they did not control the devices (doh) and like the rev. share greed also wanted ‘hefty’ data fees for ‘potential’ customers. At any rate, the result was basically.. not good.

Equally critical in the whole scheme of things was a low monthly subscription fee model in Japan as opposed to a freemium effort hopefully supported by ads along with continued and various nags, or perhaps one time paid event for a dollar or two. A Japanese player that provided awesome product, for somewhere between $1 and $3 per month to access, had the ability to forecast income and continue to improve existing products while building new offerings. Knowing that you have, for example, 200k users paying $3 per month in April.. it’s pretty good guess they would earn the same – or ideally more – come November. Pause to consider the big boy business approach of telcos.. yep, they bill on recurring monthly basis for services of agreed contract terms.

Now what.. indeed. Maybe MSFT and/or Rim will play ‘disruptive’ and sweeten the deal with 80/20 to attract devs (not holding our breath) and certainly as the power of platforms – Discovery and Billing – lose justifiable merit we’ll start to see what happened here after the honeymoon was over.. The Internet. Yep.. while Japanese telcos ‘mandated’ Flash on all devices back in 2004 – ahuh, on feature-phones almost a decade ago – in no small part to drive data adoption, certain folks in the new app world order had issues with crumbling walled garden futures that approach enables. Perhaps our favorite quote, also going back to the days of the ecosystem images above, is: “If you like the App Store – You’re Gonna Love the Internet®” because that’s exactly what happened here and is already becoming more noticeable elsewhere.

So.. what about those all-important bits, literally icing on the cake, in the (dumb, smart or happy) pipe? It’s truly a shame the initial rush to market has established insane rev. share and ‘life should be free’ benchmarks, that said a few alternatives seem possible. While still early days, billing via the likes of PayPal for reasonable settlement fees combined with publishers who have legacy subscription models and high value products, which could also easily be of the narrow niche variety, suggest we will see the fatigue of modern day AOL’s playing out in the mobile space as well.

To be sure the baby-steps of having the managed platform is critical and many players will ably make their way, past – present and future. The point would be; some potential diamonds will fall through that gaping void, the ‘valley’ of death, and we may never know what could have been had they managed to stabilize.