DoCoMo's Blackberry: Q&A with Research in Motion Japan

The pending Japan arrival of Research in Motion (RIM)’s hyperpopular BlackBerry email device, widely known as the ‘CrackBerry’ for its simple, efficient and addictive delivery of corporate email, will inject a new dimension into this country’s complex device and service matrix.

The pending Japan arrival of Research in Motion (RIM)’s hyperpopular BlackBerry email device, widely known as the ‘CrackBerry’ for its simple, efficient and addictive delivery of corporate email, will inject a new dimension into this country’s complex device and service matrix.

A wise move or a sign of desperation? These two viewpoints seem to characterize media, pundits’ and bloggers’ responses to last month’s announcement that DoCoMo would bring the BlackBerry email device into Japan, in partnership with RIM, based in Canada. Our own take on it was: Who Cares? WWJ was mindful that “virtually everyone in Japan’s workforce already has an always-on, fully connected email device right in their back pocket — in other words, a phone!”

Furthermore, before and since then, there has been more news, helping make it even more difficult to assess the BlackBerry’s prospects.

According to the pundits, NTT DoCoMo’s decision to import the BlackBerry is either (a) a master stroke aimed at securing the giant carrier’s corporate mobile offerings as 3G competition heats up in 2006/07, or (b) expensive folly that will see enterprise sales teams saddled with a clunky, ‘not-made-here’ device that competes poorly if at all against universal 3G phones that already receive push mail in real time, thank you very much (and some media reports have stated the first Japan BlackBerrys won’t even accept Japanese text input). The truth, however, is probably somewhere between these extremes, and so WWJ went straight to the source.

Since May, we’ve known that Vodafone/SoftBank are aggressively planning the launch of Nokia E-Series (E60, E-61) devices this fall; just this month Willcom announced a new version of their super-sexy, extremely popular WZero-3 Windows Mobile PDA made by Sharp; and, just this week, DoCoMo themselves announced that the “hTc Z” Smartphone, equipped with the Microsoft Windows Mobile 5.0 Japanese-edition operating system, would hit the streets before August.

(WWJ will have video reports of both the E-Series devices and the HTC Smartphone next week. — Eds.)

And you just know that Son, IP Mobile and eAccess — the new 3G licensees — are hardly lazing about on their futons practicing ikebana. I’d be highly surprised if these three are not actively working on bringing cheap(er) Korean- and Chinese-made PDA devices into Japan for 2007.

Against this background of tough and growing competition, the specific details of the first BlackBerry model for Japan have been of intense interest. The most significant criticism leveled at the DoCoMo-RIM plan is that the initial device may only be a hastily adapted BlackBerry 8707 that can’t even accept Japanese text input (see comments here). It’s widely assumed (even by us) that this weakness would be a show-stopper.

But the reality is more complex and indeed there may be tech solutions already available for the Japanese input issue and, ultimately — and depending on DoCoMo’s overall strategy, the specific device capabilities may not matter that much.

To try and get an accurate take on the situation, WWJ conducted an email interview with RIM’s man in Tokyo: Nobuhisa Yoda, Senior Director, Japan Products, Research In Motion Japan Ltd., via RIM PR and we are delighted to present their responses below.

Once you’ve read the Q&A, read on below for our take on the implications of the company’s Japan plans.

Q&A With RIM

- Which device model(s) will you deploy in Japan first? What about follow-on plans in 2007?

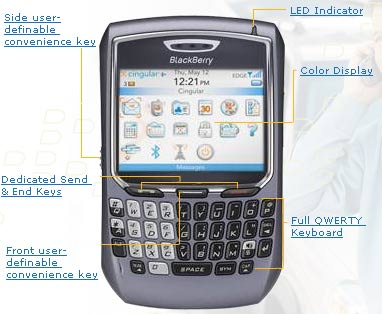

DoCoMo and RIM announced that the BlackBerry devices to be sold in Japan will operate on both W-CDMA (UMTS) and GSM/GPRS networks and will be useable around the world for voice and data communications. The devices will have QWERTY keyboards, similar to those of PCs, for fast and easy thumb typing. However, specific details on the device model, software, service pricing, etc. will be made available at the time of launch (autumn 2006). - Will BlackBerry be sold to all customers (retail, consumer), or only to corporate clients (via carrier enterprise sales)?

NTT DoCoMo is targeting corporate users that need mobile business solutions. Business workers in Japan would be most interested in the BlackBerry Enterprise Server software, which tightly integrates with Microsoft Exchange, IBM Lotus Domino or Novell GroupWise to provide secure and synchronized access to their email (push-based), calendar, contacts and tasks. DoCoMo will decide which distribution channels are most appropriate to sell BlackBerry and will announce this at a later time. - What comes bundled? What server software? What specific services will end-users receive? (email, obviously, but also… ?)

A corporation would typically purchase BlackBerry Enterprise Server (for Microsoft Exchange, IBM Lotus Domino or Novell GroupWise) and client access licenses for each user along with the devices and service (data plan or both a voice and data plan). The customer would install BlackBerry Enterprise Server (behind the corporate firewall) to connect to the email server.As mentioned, the BlackBerry Enterprise Server software tightly integrates with the messaging system to provide secure and synchronized access to push-based email, calendar, contacts and tasks. BlackBerry Enterprise Server includes the ability to integrate with for Enterprise Instant Messaging (IM) – Microsoft Office Communications Server, IBM Sametime or Novell GroupWise Messenger.

The BlackBerry solution is also a platform for enabling mobile applications. This piece is called BlackBerry Mobile Data System (BlackBerry MDS); it provides a complete and optimized framework for creating, deploying and managing wireless applications for BlackBerry devices. BlackBerry MDS extends the security model and push-based data capabilities of the BlackBerry platform by means of a series of industry standard development tools for creating thin-client (i.e. Web browser), Java (JDE – the BlackBerry Java Development Environment) or BlackBerry MDS Studio for Web services-based applications. These tools are available as a free download from RIM’s Web site. The BlackBerry platform now has a large and growing ecosystem of third-party developers with hundreds of business applications for BlackBerry, such as field service, sales force automation, CRM, healthcare, transportation, logistics and SAP systems.

- Will your devices be adapted/customized for Japan? What about Japanese text/character display and input?

Specific details on the devices that will be sold into Japan will be made available upon launch. To be clear, the BlackBerry service itself supports Japanese content. Initially, Japanese text/character display will be supported. DoCoMo is considering providing an application that will enable Japanese input on a BlackBerry device. - In general terms, how can you compete in a market where virtually 100% of cell phones already have full email access? What about third-party mail service providers (e.g. NetVillage), which enable corporate mail to be delivered via proxy server to i-mode, Vodafone, KDDI customers’ phones?

The value of BlackBerry is that it delivers a complete, end-to-end wireless solution comprising innovative handsets for voice and data communications with enterprise server software that provides secure push-based access to email, organizer, web and corporate data. It provides the IT department with the granular controls for easily managing wireless deployments. BlackBerry is secure, reliable and above all a great user experience. - How significant will the carrier’s help be in your market entry? What are your plans/requirements for establishing a sales/marketing/advertising/service infrastructure in Japan?

RIM typically works very closely with carriers to launch BlackBerry in markets around the world. We have dedicated teams that work closely with the carrier’s sales organization. RIM has a local office in Tokyo and is currently expanding the team in Japan. - A significant part of RIM revenue comes from device sales, yet the Japan device market has proven that retail prices for new phones typically plunge by 40-60% within six months of hitting the market. What can you do to maintain prices in a fiercely competitive market?

Although the bulk of RIM’s revenues come from device sales, the value of BlackBerry is that it delivers a complete, secure and reliable end-to-end solution. Tens of thousands of enterprises have deployed BlackBerry Enterprise Server, thousands of developers are creating unique applications for the BlackBerry platform, and users continue to select BlackBerry because of those values. - Many potential Japanese end-users will be unfamiliar with the concept and functioning of an “email device” vs. a phone. What can you do to educate the market?

To be clear, BlackBerry devices are also phones. We educate the market about having access to their corporate data and the importance of having access to that information. We have studies (see link below) that show how quickly companies re-coop their investment in BlackBerry. There are also many documented case studies about companies that have deployed BlackBerry.Ipsos-Reid study on ROI (Return On Investment) http://www.BlackBerry.net/select/roi/index.shtml

There are also many case studies posted here:http://www.blackberry.com/products/blackberry/using_blackberry.shtml

- Competitors like Vodafone/SoftBank are aggressively pushing business-targeted email devices in Japan (e.g. Nokia E-Series). How will his affect your sales?

This is a very good thing since Nokia is a large and respected vendor in the industry. If they are promoting the value of wireless email, it will help raise more awareness in the market place. Although RIM competes with Nokia, we also work with them, as the Nokia E-Series devices are supported on the BlackBerry platform with BlackBerry Connect (which is already available in Europe). BlackBerry Connect is software that integrates with the native email application of the device, and allows that device to be deployed and managed with BlackBerry Enterprise Server, along with all the benefits of our server solution. - Roaming is a key feature for corporate customers. Japan has no GSM – only 3G (W-CDMA on DoCoMo). Will your devices offer dual-mode, or some other kind of roaming?

Yes, as indicated, the BlackBerry devices to be sold in Japan by DoCoMo will operate on both W-CDMA (UMTS) and GSM/GPRS networks and will be useable around the world for voice and data communications.

WWJ Chief Editor Daniel Scuka comments:

Overall, not the best of responses to our series of questions, but far from the worst.

Japanese input. One key nugget in the Q&A above is the Japanese-input issue. RIM and DoCoMo are obviously aware of it and are considering options. Note that DoCoMo have already developed a Java-based Japanese-language module (Nanimail) that works with the BlackBerry, so this problem may simply go away. One WWJ reader wrote in recently to mention that he’s used the module in the UK and it works fine. But this remains a major issue to solve and if it isn’t by the launch time, I hope DoCoMo doesn’t expect to sell too many BlackBerrys.

i-mode access. Another key issue is battery life and i-mode support; RIM added that “DoCoMo and RIM haven’t released feature-specific information on the product such as battery life, i-mode support etc. but this information will be available at time of launch.” While it’s hard to imagine DoCoMo actively pushing any device that doesn’t offer i-mode (the only past nono-imode example that comes to mind was the M-1000), it could happen if the device is narrowly targeted at corporates, verticals (medical sales, photocopier maintenance) and non-consumers. Note the carrier has already had their 7-Series of ‘FOMA-lite’ phones available for some time as there clearly are some consumers who don’t want all the mobile Internet bells and whistles, but even these feature i-Channel push information. Presumably this extends to corporate users as well.

Device vs. server revenues. The quick fall of device prices at retail won’t affect the BlackBerry if it’s maintained as a corporate-only offering. It looks like DoCoMo will grab most of the device revenue for themselves, while leaving RIM to profit on sales of the BlackBerry server software and value-added features. Yet there’s no way RIM can do that, initially, until they’ve built up a corporate sales force and so, at least at first, I see DoCoMo even grabbing most of that revenue as well. The result is that even if RIM stays in Japan for the long-run, it will take a lot more human capital and country sales investment before profits could be significant.

Competition. Well, there’s lots of it. I’m not convinced that RIM have clearly conceived their strategy for dealing with Nokia, Vodafone/SoftBank, etc., but perhaps they are simply trusting to DoCoMo. That may not be a mistake; the carrier has recently enhanced their business sales efforts (and the online corporate sales portal), and if RIM merely plays the role of a tech vendor to DoCoMo, the partnership could still turn into a solid, if modest, money maker.

Conclusion. For WWJ, the jury is out. It’s still too soon to criticize or congratulate them, but we do applaud the effort to at least get started. In the meantime, Willcom’s selling WZero-3s, DoCoMo is selling HTCs, and Symbian just held their Symbian Summit 2006 event — all of which points to growing and significant competition. Final note to RIM & DoCoMo: hurry up!

— Daniel Scuka